Part of what makes city life so rich is having access to a wide range of vibrant arts programming. But arts programs—especially smaller, community-based ones—are rarely well-funded. In order to understand the makeup and distribution of arts funding across the city, the Boston Foundation sponsored research into the key funding needs for the arts community in Boston. The fruit of that labor, “How Boston and Other American Cities Support and Sustain the Arts,” finds that the city’s small and medium sized cultural institutions lack significant public funding and are instead largely self-funded, through ticket sales and contributions from individual donors. In response to these findings, this month the Boston Foundation held a forum to highlight innovative local options for raising new public funding for the arts that have been implemented in other parts of the United States.

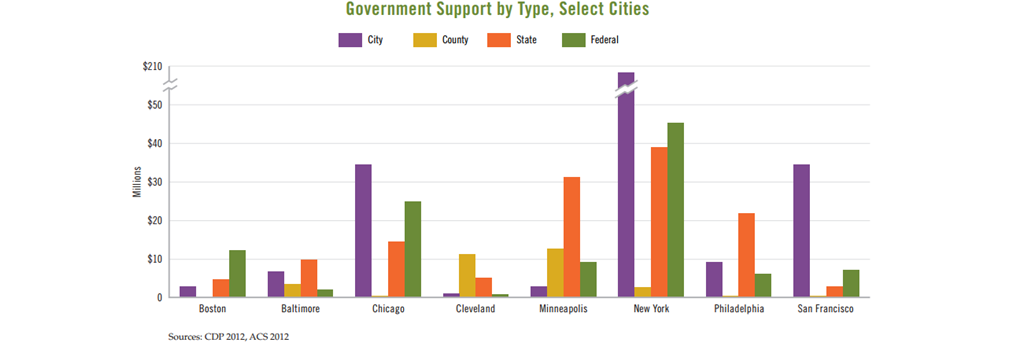

Compared to other cities, Boston arts organizations receive very little state and local funding. Shown in the graph below, just over $10 million of the Boston art scene’s public funds came from the federal government in 2012, with significantly less support coming from the city or the state. Boston is the only city of those examined where federal funds make up a plurality of governmental level support.

Unfortunately, Boston’s options for expanding local funding of the arts remains limited by its homerule charter. In Massachusetts, any local tax increase must first be approved by the state. In most other states, cities can levy new local taxes without state approval.

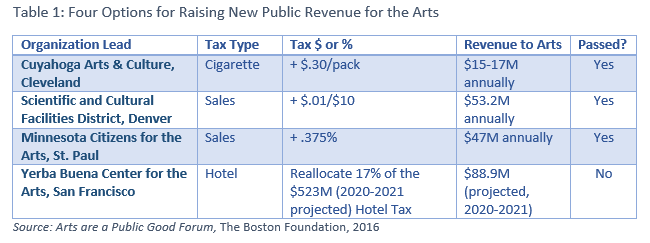

In order to develop ideas for a possible local campaign in Boston, this month’s “Arts are a Public Good” forum included a number of experts who have had their own experiences running arts funding campaigns, including Karen Gahl-Mills from Cleveland's Cuyahoga Arts & Culture, Deborah Jordy from Denver’s Scientific and Cultural Facilities District (SCFD), Sheila Smith from the Minnesota Citizens for the Arts and Jonathan Moscone from San Francisco's Yerba Buena Center for the Arts (YBCA). Details on their local arts financing strategies are summarized in the table below.

For the three successful campaigns, these resources provide ongoing support to hundreds of new arts groups within their catchment areas.

Campaigns

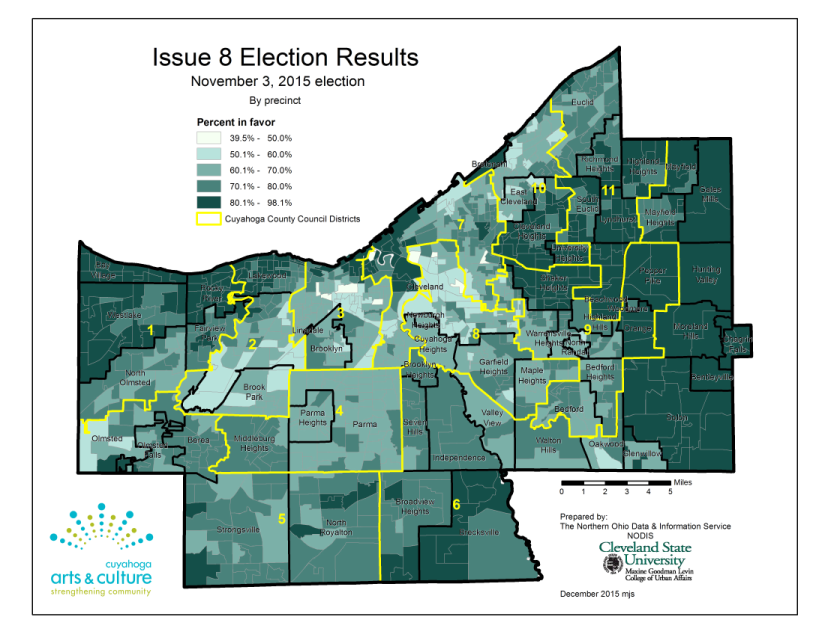

Each of these organizations undertook an advocacy campaign to get their measures on the ballot and then make the public case for support on Election Day. Each of these campaign also had different win requirements. In Cleveland, the Cuyahoga Arts & Culture group was able to successfully get funding for the arts passed on the ballot in 2006 (56/44 percent). Nine years later, when the initiative was up for renewal, it passed again by an even larger margin of 50 percentage points, 75 to 25 percent. In both instances, all that was needed for passage was a simple majority of 50 percent or more.

A couple states over in Minnesota, after a significant legislative push the Legacy Campaign won a similar majority of 56 percent of the vote and a new tax supplement in 2008. Meanwhile in Colorado, SCFD’s penny tax supplement passed in 1988 (public information on the margin is not available).

In San Francisco, though the Yerba Buena sponsored initiative “Yes on S” ran up 64 percent of the vote, they did not get the 2/3rds (67 percent) they needed to in order to shift Hotel Tax resources. Nonetheless, organizers took some valuable lessons from the campaign. In particular, they wish they had spent more money in support of their advocacy efforts. Even while spending only $500,000 on their campaign, they came within three percentage points of winning.

Outcomes and Goals

The goals of these campaigns were remarkably similar. They all sought to:

- Improve overall access to the arts

- Expand arts organizations into new markets

- Increase the frequency that arts events and museums were offered free to the public

- Support individual artists in the development of new work.

YBCA had an additional goal that was not specific to the arts, which was to build a broader public funding base for homelessness prevention and treatment. For San Francisco, where 2,000 families are homeless, prevention is a serious issue. This hit home for many of the San Franciscan artists as well: 70 percent of local artists classified as at-risk were found to be displaced, or in the process of being displaced from their homes and workplaces. As a result of these factors and others, the coalition for Yes on S recognized the need for homelessness prevention, and consequently expanded its ask of voters.

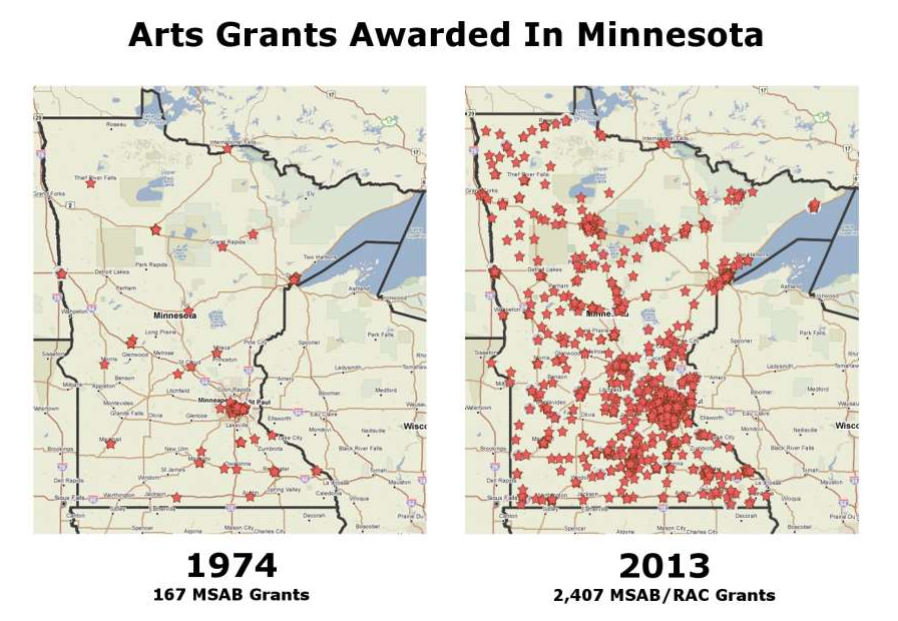

The new revenue streams have helped the areas achieve these goals. In Cleveland, the cigarette tax helped boost total giving within Cuyahoga Arts & Culture to $38.1 million for 58 organizations through the 2015-2017 period. Without the tax, the Cuyahoga Arts & Culture budget would rest at around $21 - $23 million annually. In the Denver area, the Scientific and Cultural Facilities District (SCFD) contributes roughly $53 million to the arts in the region, gained from a penny tax adopted in 1988. They now support almost 300 different organizations: 250 community-based organizations, 28 larger regional organizations, and 5 national and international organizations. Likewise, in Minnesota, the Legacy Campaign helped grow available funding for grantees from $1.4 million (2015 dollars) in 1974 for 167 grantees to $34 million in 2015 for 2,500 grantees. The difference in the depth and breadth of Minnesota’s expanded grantee list can be seen plainly in the image below.

The direct pre- and post-amendment eras tell an even more interesting story. Before the amendment, Minnesota handed out 1,219 grants to organizations in the field, for a total of $10.2 million in 2008. Six years later, Minnesota tripled that number, and in 2014 gave out $34.2 million in grants to around 2,200 organizations.

In San Francisco, the YBCA’s efforts – had they been successful – would have allowed the arts community to a share of the Hotel Tax Fund would have been divided up as follows:

- 25% towards Grants for the Arts

- 20% to Neighborhood Arts Programs

- 10% to the Arts Commission

- 20% to War Memorial Buildings

- 25% to the Cultural Equity Endowment Fund

An additional 4 percent of the Hotel Tax Fund – amounting to $18.8 million – would have gone to the Ending Family Homeless Fund.

Yerba Buena may yet make another effort to get the initiative passed - while applying lessons learned from their first campaign and other successful arts funding campaigns, and ensuring they spend the money they need to get 2/3rds of the vote necessary to pass. Perhaps Boston, too, can take lessons learned across these municipalities and apply them to our own goals and experiences.

Key Data from the Arts are a Public Good Forum

By Peter Ciurczak

February 24, 2017